When I first moved back to Busan after years abroad, one of my closest foreign friends — an English teacher from Canada — called me in a bit of a panic.

“I can’t pay my rent because I don’t have a Korean bank account yet.

They said I need my ARC, but I don’t even know where to start!”

That moment reminded me how confusing this simple step can be for anyone new to Korea.

Even locals forget how paperwork-heavy our banking system can feel, especially when every form is in Korean and the process seems different at every branch.

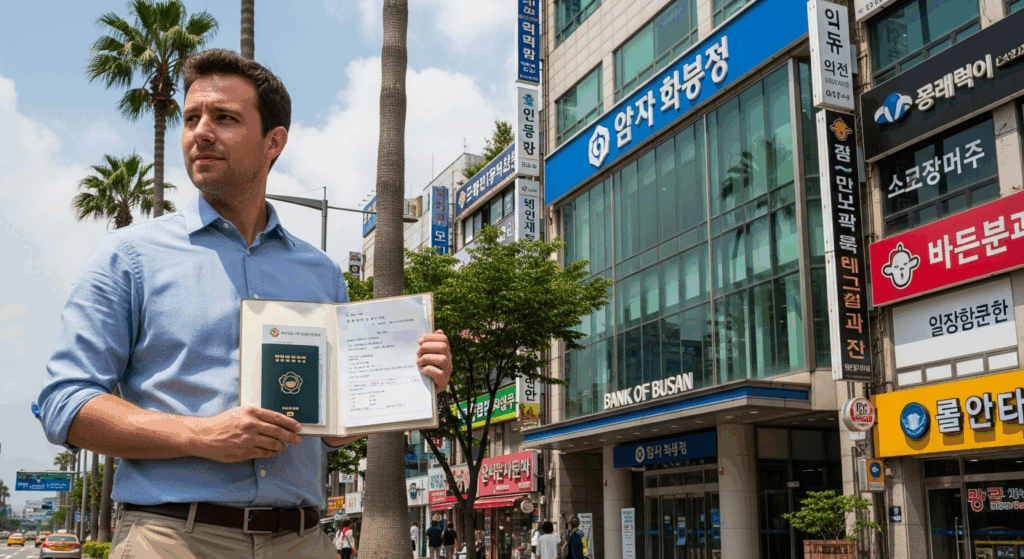

So I spent an afternoon walking her through everything — from finding an English-friendly branch in Centum City to setting up mobile banking before she left.

By the end of the day, she had her new account, her debit card, and a big smile.

That same evening, she texted:

“I just paid my rent online for the first time — it feels like I actually live here now!”

If you’ve just arrived and need to open a Korean bank account in Busan, this guide will help you do exactly that — step by step, without confusion.

We’ll cover which banks are best for foreigners, what documents you need, how to open your account in person, and how to use it for everyday life here in Busan.

Whether you’re a student, a digital nomad, or starting a new job by the sea,

this local-friendly guide will help you feel at home — and fully equipped to live like a true Busan resident. 🌊

1️⃣ Choose the Right Bank for Foreigners in Busan

When you first arrive in Busan, it can be overwhelming to see so many bank signs — KEB Hana, Shinhan, KB Kookmin, Woori, and Busan Bank on almost every street.

But not every branch is equally friendly to foreigners, especially if you don’t speak much Korean yet.

So before you walk into the nearest one, it’s worth knowing how the system works here.

In Korea, most banks are national (they operate across the whole country), but Busan also has its own local bank — Busan Bank (부산은행).

https://gbank.busanbank.co.kr/

This one is often the easiest choice if you live in this city, because local staff are more used to helping foreigners who just moved in, especially around areas like Haeundae, Centum City, Gwangalli, and Seomyeon, where many international residents live.

Their forms are simpler, and some locations even have English-speaking staff or printed English guides.

If you plan to receive your salary or make international transfers, consider one of the larger nationwide banks like KEB Hana Bank, Shinhan Bank, or Woori Bank.

These banks usually have English mobile apps, international remittance options, and staff who can assist with global cards or foreign currency.

For example:

- KEB Hana Bank specializes in accounts for foreign workers and students; it’s connected with many overseas banks.

- Shinhan Bank offers the “SOL Global” app with English and other language options.

- KB Kookmin Bank is very stable and recognized internationally — good if you plan to stay long-term or apply for a credit card later.

You can open an account at any branch, but not all branches have English support.

In Busan, good places to start include:

- Hana Bank (Centum City Branch) – easy to find, near Shinsegae Department Store.

- Shinhan Bank (Haeundae Branch) – often used by foreign teachers and digital nomads.

- Busan Bank (Gwangalli Main Branch) – very familiar with foreign residents.

💡 Local tip: If you go to a smaller neighborhood branch, the staff may not speak English but will still be very kind.

Bring your documents neatly organized, use a translation app if needed, and don’t hesitate to smile — Koreans appreciate polite effort.

2️⃣ Prepare Your Documents Before You Go

Opening a bank account in Korea is not difficult, but it is very document-sensitive.

Unlike in some countries where you can open an account online with just your passport, Korean banks need several official papers to verify who you are and why you need the account.

If one document is missing, they’ll politely ask you to come back another day — so preparing everything beforehand will save you a lot of time.

Here’s exactly what you need to bring:

🛂 1. Passport

Your passport must be valid (not expired) and show your visa status.

For example, if you’re in Korea on a student (D-2) or work (E-2, E-7) visa, the bank staff will check this to confirm you’re legally staying in the country.

They’ll photocopy the main page and sometimes the visa page.

🪪 2. Alien Registration Card (ARC)

This is the most important document.

The ARC (외국인등록증) is an ID card issued after you register at the immigration office.

You usually get it two to four weeks after arriving in Korea.

Without it, some banks can still open a temporary account, but that account will have restrictions — for example, you might not be able to use internet banking or receive large deposits.

If your ARC hasn’t been issued yet, bring your receipt from the immigration office showing that your card is being processed.

Many banks in Busan accept that as temporary proof.

Once you receive your physical card, you can return to the bank and upgrade your account to a full version.

📞 3. Korean Mobile Phone Number

You’ll need a local phone number for text message (SMS) verification and for logging into the mobile banking app later.

If you don’t have one yet, get a prepaid SIM card first — it’s much easier to open your account once your phone is working.

🏠 4. Proof of Korean Address

Banks must confirm that you actually live in Korea.

You can show your rental contract (전월세 계약서), a recent utility bill with your name, or a letter from your employer or university dormitory.

Sometimes they’ll simply check that your address matches the one registered with your ARC.

💼 5. Proof of Purpose (Optional but Helpful)

Korean banks often ask, “What will you use this account for?”

If you’re working, bring your employment contract or a business registration certificate (if you’re self-employed).

If you’re a student, bring your school enrollment letter.

These help the bank understand you’re a genuine resident and not opening an account for illegal purposes (Korea has strict anti-money-laundering rules).

💡 Additional Tips

- Always bring originals and copies — many banks still use paper documents.

- Have some cash (₩10,000–₩20,000) ready to deposit when you open the account.

- If your Korean is limited, write your address and phone number on paper beforehand to hand to the staff easily.

- Bring your own pen and take your time filling out forms — there’s no rush.

3️⃣ Go to the Branch in Person

In Korea, most banks still require you to open your first account in person — especially if you’re a foreigner.

Even though some Korean citizens can open an account online through apps, foreigners must visit a branch at least once so that the bank can check your identity and documents directly.

So don’t worry — you’re not doing anything wrong by walking in! Everyone does this the first time.

🏦 What to Expect When You Arrive

When you enter the bank, you’ll see a small machine near the entrance that gives out queue numbers.

Tap the screen and choose “Account Opening” (계좌개설) or simply press the button labeled “Other Services.”

Take the printed number slip and wait for your turn.

There are usually 5–10 counters, each serving different things: account opening, deposits, loans, card services, etc.

When your number is called, go to the counter that lights up your number on the digital board.

If you’re nervous about the language barrier, here’s a simple sentence that always works:

“안녕하세요. 외국인인데 계좌 만들고 싶어요.”

(“Hello, I’m a foreigner and I’d like to open a bank account.”)

If you’re not comfortable saying it, just show your passport and ARC card together and smile — the staff will immediately understand.

✍️ What Happens Next

The staff will:

- Ask to see your passport and ARC.

- Check your visa type and address.

- Ask if you already have an account at another bank (foreigners can only open a limited number of new accounts within a short period).

- Hand you a form to fill out — usually in Korean, sometimes bilingual.

If you can’t read Korean, don’t panic. Just fill in the basics:

- Your name (as shown in your passport)

- Your address in Korea

- Your phone number

- Your email address (optional)

- Reason for opening the account (salary, rent, daily use, etc.)

Once you complete the form, return it with your documents. The teller will check everything and might ask short questions like:

- “Do you work in Korea?”

- “Do you want a card?”

- “Do you need online banking?”

If you don’t understand, just say, “Sorry, English please,” and they’ll either explain slowly or use a translator app.

💵 Final Steps Before Leaving

After approving your application, the staff will:

- Ask you to deposit a small amount of money, usually ₩10,000–₩20,000.

- Print your passbook (통장) and sometimes your debit/check card on the spot.

- Offer to help you register for mobile banking (you can do it right away or later).

The whole process usually takes 20–30 minutes if your documents are ready.

Congratulations — you now have your first Korean bank account!

4️⃣ Choose Your Account Type

Once you start the application, the teller will ask which type of account you’d like.

It’s helpful to know the difference because each account has its own purpose and benefits.

Here’s a simple breakdown:

💰 Regular Deposit Account (입출금 통장)

This is the most basic and popular type for foreigners.

It allows you to deposit and withdraw anytime, receive your salary, pay bills, and use a debit card.

Think of it as your “everyday life account.”

Perfect for:

- Receiving salary or freelance payments

- Paying rent and utilities

- Online shopping on sites like Coupang, Naver, or Baemin

You’ll get a bankbook (small booklet) and a check card (like a debit card) linked to this account.

🏦 Salary Account (급여통장)

If you work full-time in Korea, your company may ask you to open an account at a specific bank.

This is called a “salary account.” It’s similar to a regular account but may have no-fee transfers or higher ATM limits.

You can ask your employer which bank they use to make payday easier.

Perfect for:

- Foreign teachers, engineers, or office workers in Busan

- Anyone who receives monthly pay directly from a Korean company

🌍 Foreign Currency Account (외화 통장)

If you often send or receive money internationally — for example, sending funds back home or paying tuition —

you’ll want to open a foreign currency account.

You can hold money in USD, EUR, or other currencies and transfer globally through SWIFT codes.

KEB Hana Bank and Shinhan Bank are known for smooth foreign remittances and competitive exchange rates.

Perfect for:

- International students receiving overseas remittances

- Remote workers or freelancers paid in foreign currency

📈 Time Deposit or Savings Account (예금, 적금)

Once you’re settled and want to save money safely, consider these options later.

They offer better interest but require you to keep the money untouched for a period (e.g., 6–12 months).

Perfect for:

- Long-term residents or families living in Busan

- Those planning to save regularly each month

💡 Local Tip: Most foreigners start with a regular deposit account first.

You can always add more account types later once your Korean improves or your financial needs change.

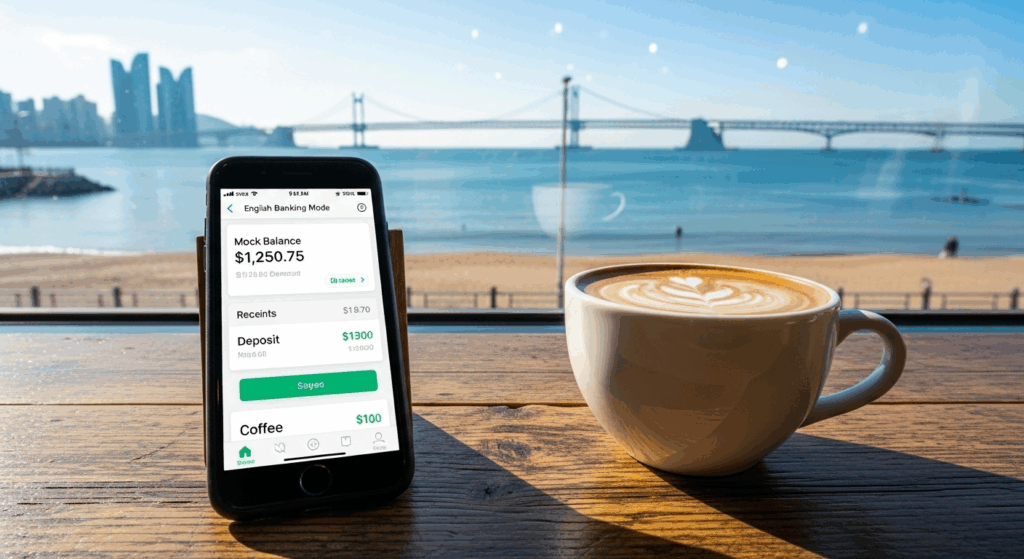

5️⃣ Set Up Mobile Banking and Online Access

After your account is open, the teller will usually ask:

“Would you like to register for mobile or internet banking?”

You should say yes — this step makes your life much easier in Korea.

📲 Why You Need Mobile Banking

Korea is a cashless society. Most payments happen via apps like Naver Pay, Kakao Pay, or direct bank transfers.

If you can’t use online banking, even simple things like paying your phone bill or transferring rent become inconvenient.

Mobile banking lets you:

- Check your balance anytime

- Send and receive money instantly

- Pay bills and top up transport cards

- Link to shopping apps like Coupang or Baemin

⚙️ How to Set It Up

- Download your bank’s app while still inside the branch.

Ask the staff which version supports English.

Examples:- Shinhan Bank → “SOL Global”

- KEB Hana Bank → “Global 1Q Bank”

- Woori Bank → “Woori Global Banking”

- Busan Bank → “BNK Busan Bank Global App”

- The teller will help you create an online ID and password, and link your phone number for verification.

- You’ll get an authentication certificate (공동인증서) inside the app — this is like a digital signature used for security in Korea.

- Make sure to enable English language mode in the settings (if available).

If your app doesn’t support English, don’t worry.

Most foreigners use a translation app like Papago or Google Translate Lens to navigate.

Once you get used to it, it’s very intuitive — Korean banking apps are quite advanced.

🧾 Optional: Internet Banking on Your Computer

If you prefer using a laptop, you can also sign up for internet banking.

However, Korean websites often require installing digital certificates and security plugins, which can be tricky for foreigners.

That’s why most expats now rely mainly on the mobile app — it’s faster, simpler, and works in English.

💡 Busan Tip

When I helped a friend open her first account in Centum City, the teller kindly set up her app and made her send ₩1 to her own account to test it.

They laughed together when the money “arrived instantly” — it’s that fast.

Don’t be shy to ask for a quick demo before leaving.

Once you can log in, send money, and check your balance — you’re officially ready to live like a local in Busan.

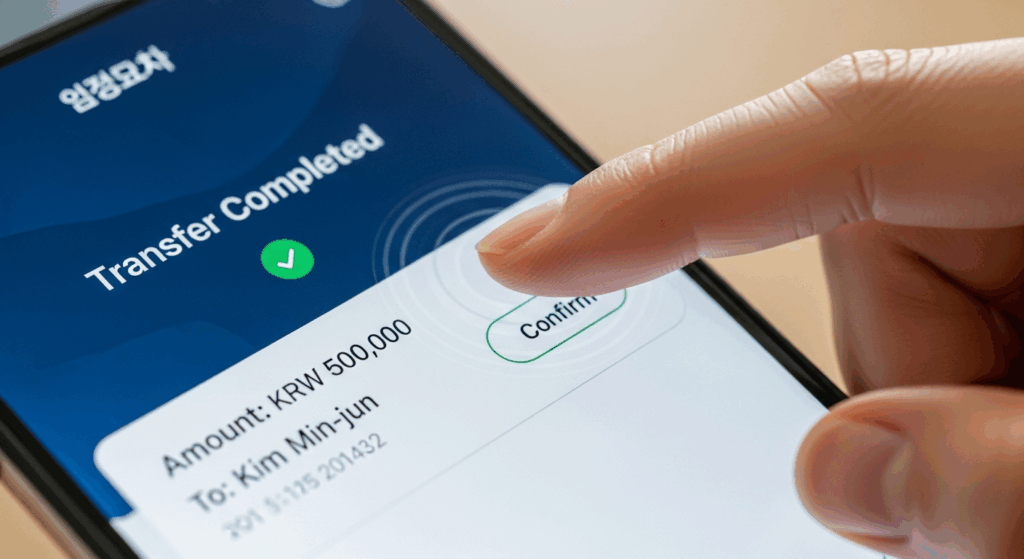

6️⃣ Use Your Account for Everyday Life in Busan

Now that you’ve managed to open a Korean bank account in Busan, you’ll realize just how much easier daily life becomes.

Everything in Korea — from paying rent to ordering lunch — connects to your bank account.

Here’s how to make the most of it once it’s ready.

💸 Pay Rent and Utility Bills

Most landlords in Busan will ask you to transfer rent by bank transfer (계좌이체) each month.

It’s very common to receive a small printed card from your landlord or real estate agent with their account number written on it.

You simply open your bank app, select “Transfer,” and type in their account number.

The transfer is instant — the money arrives in seconds.

For monthly utility bills like gas, water, and electricity, you can also pay directly through your banking app or set up automatic payments (자동이체).

It’s the easiest way to avoid late fees, especially if you’re busy working or studying.

💡 Local tip: Busan’s city gas company (부산도시가스) allows direct debit payments if you bring your bill and bankbook to the branch once — they’ll handle it afterward automatically.

☕ Everyday Shopping and Cafés

Busan is a cashless city. You can link your debit card or bank account to payment apps like Naver Pay, Kakao Pay, or Toss.

This allows you to pay instantly at cafés, restaurants, or online stores.

You’ll notice that even local street cafés around Seomyeon, Gwangalli, or Centum City accept mobile payments.

If your card has a “check” mark (체크카드), it works like a debit card — the money comes out right away from your account.

💡 Example: At a Gwangalli café, when you tap your card on the terminal and see “결제 완료” on the screen — that’s it, payment done.

No signatures, no waiting.

🛍️ Online Shopping & Delivery Apps

Once you open a Korean bank account in Busan, you can start using Coupang, Naver Shopping, Market Kurly, and food delivery apps like Baemin (배달의민족) or Yogiyo.

Most of these platforms require a Korean bank card or account linked for payment.

The good news is that the process is quick — when registering, simply choose your bank name and verify with a short SMS code.

Then you can order everything from groceries to home appliances without needing cash or a foreign card.

🏦 Receiving Salary or Freelance Payments

If you’re working in Korea — as an English teacher, remote worker, or freelancer — your Korean employer or client will ask for your bank name and account number (은행명, 계좌번호).

They’ll send your salary directly there, usually on the same day each month.

The most commonly used format is:

Bank Name + Account Number (e.g., KEB Hana 123-456-789012)

💡 Busan reality check: Many language academies, startups, or content agencies prefer KEB Hana or Busan Bank, as both handle foreigner accounts easily and can issue quick remittance proofs if needed for taxes.

🚍 Public Transport, Phone Bills, and Everyday Services

Your bank card can also double as a T-money transportation card for buses and subways.

Just ask the teller to activate “transportation payment” when receiving your card.

You can recharge it automatically through your bank app or at convenience stores.

If you have a Korean phone plan, link your bank account to your telecom provider (SKT, KT, LG U+) so that your monthly bill is paid automatically — no more paper invoices or late fees.

🧾 Keep Track of Your Spending

Most Korean banking apps show spending summaries and graphs — perfect for budgeting.

You’ll see categories like “Food,” “Shopping,” “Transport,” and “Bills.”

It’s a great habit to check once a week, especially if you’re managing life abroad.

💡 In short:

After you open a Korean bank account in Busan, you’ll find that it’s not just a financial tool — it’s the foundation for living comfortably here.

Your card becomes your rent payer, your café pass, your online wallet, and your subway ticket — all in one.

7️⃣ If You Don’t Have Your ARC Yet

Many foreigners who just arrived in Busan face the same problem:

“I need a bank account, but I don’t have my Alien Registration Card (ARC) yet.”

Don’t worry — it’s still possible to open a limited (temporary) account, depending on the bank and branch.

🪪 What Is a Temporary Account?

A temporary or “restricted” account (제한계좌) is an account that allows you to deposit and withdraw money,

but limits certain features like online banking or large international transfers.

It’s meant to help you settle in while waiting for your ARC to be issued.

Usually, you’ll need to present:

- Your passport

- Your immigration registration receipt (the paper showing your ARC application number)

- A Korean phone number

- A temporary address (hotel, officetel, or friend’s home)

Banks will note that your ARC is pending and allow you to use the account for basic transactions.

📅 After You Receive Your ARC

Once your ARC card arrives (typically within 2–4 weeks), go back to the same bank branch with your passport and ARC.

Ask to “upgrade your account” to a full resident account.

You can say:

“Hi, I got my ARC card and I’d like to upgrade my bank account.”

The teller will scan your ARC, remove the restrictions, and activate online banking and remittances.

Your account number and balance will stay the same — it’s just upgraded.

💡 Busan-Specific Tips

- Busan Bank (BNK) and KEB Hana Bank (Centum City branch) are known to help foreigners even before their ARC arrives.

They understand the immigration waiting period and often accept ARC receipts as proof. - If you’re a student in Busan universities like Dongseo or Pusan National University,

check with your international office — many have partnerships with local banks that help you open accounts more easily. - Keep your ARC receipt safe — it has your registration number, which the bank needs to verify your pending ID.

🚫 What Not to Do

Avoid opening multiple temporary accounts at different banks.

Korean law monitors duplicate accounts to prevent fraud, and you might be restricted from opening new ones for a few months.

Stick with one main account until your ARC arrives — once it’s fully active, you can open additional ones later for savings or remittance.

✅ Summary for Newcomers in Busan:

Even if you don’t have your ARC yet, you can still open a Korean bank account in Busan to handle basic daily payments.

Bring your passport, immigration receipt, and Korean phone number, then upgrade your account once your ARC card is ready.

Once you have that small plastic card in your hand, the entire Korean banking system — online transfers, mobile apps, and automatic payments — becomes fully available to you.

It’s your final step toward truly living like a local in Busan.

8️⃣ Local Insider Tips for Busan Foreign Residents

Opening a Korean bank account in Busan is just the beginning of your local life.

Once your account is active, these small but practical tips will help you feel even more at home — and avoid the mistakes many newcomers make.

💬 1. Visit Larger Branches for Easier Communication

If it’s your first time, go to major branches — for example, Hana Bank Centum City, Busan Bank Gwangalli, or Shinhan Bank Haeundae.

Larger locations often have English-speaking staff or digital translators ready to assist foreigners.

Smaller branches are friendly too, but they might not be familiar with the ARC process or foreign verification systems.

📅 2. Go in the Morning (Before 2 p.m.)

Korean banks usually operate 9:00 a.m. – 4:00 p.m., Monday to Friday.

Mornings are less crowded, and you’ll have more time for questions without feeling rushed.

Avoid lunch hour (12–1 p.m.), when staffing is reduced and queues can double in length.

💳 3. Always Carry Your ARC and Bank Card Together

You’ll be surprised how often you need both — not only for banking, but for things like SIM card registration, apartment rental, or even verifying your identity when receiving a parcel.

Keep them in a small wallet or card case and treat them as your “Korean life essentials.”

💵 4. Keep a Small Cash Reserve

While Busan is mostly cashless, some small neighborhood restaurants or traditional markets (시장) still prefer cash.

With your new bank account, you can easily withdraw cash at ATMs inside convenience stores (CU, GS25, 7-Eleven) — they’re everywhere and open 24 hours.

💡 Tip: Foreigners can use Global ATMs, usually labeled in English. Look for the “GLOBAL” sticker on the machine.

Once you link your account to Naver Pay or Kakao Pay, daily life becomes seamless — paying for taxis, coffee, or even subway tickets takes seconds.

These apps are safe, widely accepted, and essential for living comfortably in Busan.

🏖️ 6. Choose a Bank That Fits Your Lifestyle

If you’re a freelancer or remote worker, pick a bank that allows easy online transfers and English statements (KEB Hana or Shinhan).

If you’re a student, go for one that partners with your university (Busan Bank or Woori Bank).

And if you’re a long-term resident, open a secondary savings account to earn higher interest while building your credit history.

💬 7. Don’t Be Afraid to Ask for Help

Busan locals are known for being kind and patient with foreigners who try.

If you’re unsure, just say “잠깐만요 (jamkkanmanyo)” — it means “one moment please” — and use a translation app.

Even with language barriers, a little effort and a smile go a long way here.

🏁 Final Summary: Living Like a Local in Busan

By now, you’ve learned how to open a Korean bank account in Busan, step by step — from choosing the right bank and preparing documents to using your account for daily life.

Let’s recap the key points:

✅ Choose a foreigner-friendly bank such as Busan Bank, KEB Hana, or Shinhan.

✅ Prepare your passport, ARC (or receipt), local address, and Korean phone number.

✅ Visit the branch in person and bring ₩10,000–₩20,000 for your first deposit.

✅ Set up mobile banking before you leave the branch — it’s essential.

✅ Use your account to pay bills, shop online, and receive your salary.

✅ If you don’t have your ARC yet, open a temporary account and upgrade it later.

Once you’ve done all of this, you’re not just a visitor anymore — you’re living in Busan like a local.

You can pay your rent, order groceries, hop on the subway, and enjoy your new city without stress.

Opening a bank account may seem small, but it’s a big first step toward independence and belonging in Korea.

Welcome to Busan — and welcome to your new life. 🌊